With its tropical beaches and warm sun, Thailand is not only a vacation goal for tourists but also a target market for many businesses across the globe. As the heart of Southeast Asia, Thailand can offer some incredible opportunities to wine producers too. With tourism expected to grow to 34 million international tourists in 2024, an important reduction in tax excises, little local competition, and growing wages, Thailand is steadily becoming a major ASEAN market for wine producers, and wine importers from Thailand are also becoming more and more interested in finding new brands.

Table of Contents

- Thailand’s wine market.

- The Thai wine-drinking landscape.

- Opportunities of the Thailand wine market.

- Challenges of Thailand’s wine market.

- A list of wine importers in Thailand.

I. Thailand’s wine market.

To start off, it’s important to note a few basic facts about Thailand. The country has a population of 71.85 million, with 51.5% females and 48.5% males. Most of the inhabitants live in the big cities (53.9%), while the rest 46.1% live in rural areas.

Wine consumption is higher in the big cities than in rural areas, as the cities offer a more complex lifestyle, access to a variety of international restaurants, and a vibrant nightlife. Bangkok alone is a metropolis that accommodates 10 million dwellers and a couple of dozen million travelers annually.

Is wine popular in Thailand?

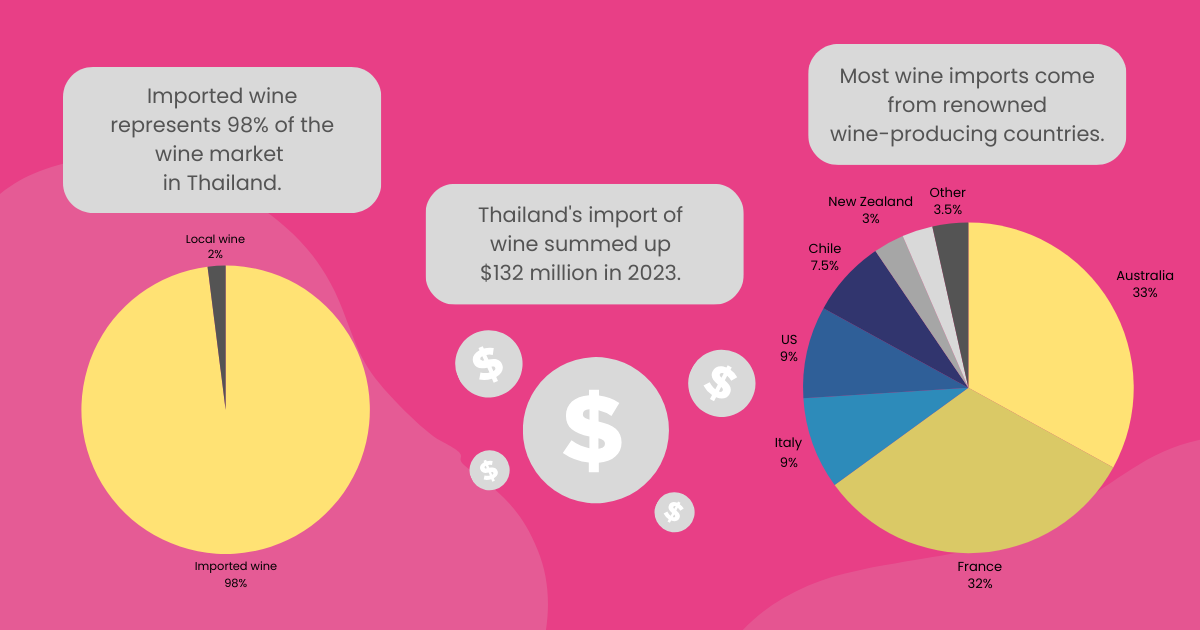

In 2023, Thailand’s imports of wine summed up $132 million, with a five-year average annual growth of around 8%. Imported wine represents 98% of the wine market in Thailand. So, it wouldn’t be a stretch to say that the best wine in Thailand is imported wine.

Most wine imports come from renowned wine-producing countries such as Australia, with 33% of the market, followed by France, with 32%. Next are Italy and the US with around 9% each, followed by Chile with 7.5% and New Zealand with 3%.

II. The Thai wine-drinking landscape

This tropical paradise hasn’t traditionally been a wine-drinking country, as local production is insignificant and wine has long been perceived as a luxury good, due to the high price of wine in Thailand.

However, wine consumption in Thailand has changed over the last years, and Thailand’s wine market is thriving now thanks to a multitude of factors, that we are going to expand on in this article.

1. Low local competition.

Local wine represents only about 2% of all wine sales in Thailand. The country’s tropical climate is not suited for wine production, as grapes need sun but also cooler temperatures.

To compensate for the incompatibility, local producers use local fruits to produce local wine varieties, which offer an option on supermarket shelves but cannot beat the premium quality of imported wines.

2. Thai wine import trends

Thailand’s alcoholic drinks market has long been split between beer and spirits, with cocktails also being a popular choice for night-outs.

Yet, in recent years, the increase in wages led Thai people to change the beer draught for the wine glass, and the modest fast foods for fine dining restaurants.

In Thai culture, wine is perceived as a sophisticated drink and is associated with social status. And as the new generation climbs the social ladder and the middle class expands, more consumers have the financial means to afford higher-priced drinks like wine.

3. Wine consumption in Thailand

The local cuisine is mostly made of spicy foods, rice, noodles, and fish which are paired with red wines (Cabernet Sauvignon or Shiraz), white wines (Sauvignon Blanc or Chardonnay), and rosés.

Red wines seem to be in Thailand’s spotlight, as they make up about 80% of all wine sales.

III. Opportunities of the Thailand wine market

1. The growth of tourism

Wine consumption in Thailand is closely tied to the development of tourism.

Last year, the tropical country was visited by 28 million international tourists, and expectations are that the number will grow to 34 million in 2024.

To have a better picture of the people who visited Thailand, 20 million tourists were from Asia, 5.6 million were European citizens, 1.2 million came from the US, and 600.000 from the Middle East.

When visiting the country, be that in seaside resorts, wellness centers, or the big cities, these people pair local dishes with familiar drinks such as wine.

2. The increasing demand for imported wines

Thailand has achieved remarkable economic progress in the last couple of years and has recovered well after the pandemic.

As the middle class expands, more consumers have the financial means to buy higher-priced products like wine. Wine is no longer seen as a luxury good but has become a common part of social gatherings, and celebrations.

Also, the young generation benefited from better education and expanded their views on culture, food and drinks through international traveling. As opposed to the older generation, Thai Millennials and Gen Z are wine enthusiasts, favoring imported wines from reputed locations around the world.

Wine tastings and educational events are other important factors that contributed to the adoption of wine consumption in Thailand. These initiatives aim to educate Thai consumers about the wine regions, grape varieties, and pairing wine with food.

3. A variety of wine distribution channels

Apart from distributing imported wines to all major supermarket chains, Thai importers also supply the country’s restaurants, hotels, and specialized bars.

Due to the large number of tourists but also to local wine enthusiasts, restaurants and hotels have embraced the wine culture, incorporating extensive wine lists into their menus.

Also, there is a considerable number of wine bars and specialized wine retailers, that cater to diverse preferences and budgets. These outlets often have educated Thai sommeliers who offer assistance and advice in selecting wine.

4. The rise of online sales

The onset of the COVID-19 pandemic set the stage for a new era in wine sales. The restrictions determined many retailers to start using e-commerce, and this transition caused a meteoric surge in wine sales.

The widespread adoption of Internet and mobile phone usage coupled with advanced delivery logistics and e-payment systems have made e-commerce shops one of the first go-to choices for wine purchasing.

There’s fierce competition among Thai wine online shops, with some offering free delivery on every order, and wholesale prices for well-known labels from famous regions.

IV. Challenges of Thailand’s wine market

1. Duties, fees & taxes influence Thailand’s wine prices

1.1. Wine import tax Thailand

Thailand’s wine tax is complex. There is a 60% tariff on imported wines, and all other taxes are calculated based on the imports’ cost, insurance, and freight value, plus the tariff cost.

Here are a few taxes and duties that may apply to wines imported into Thailand. The specific rates may vary depending on the type and country of origin of the wine. What is the import tax in Thailand?

- Custom duties may apply to wines depending on the country of origin and the trade agreements Thailand has with that country. Rates can vary between zero to a few percent.

- Excise tax is applied to all alcoholic beverages in Thailand and varies depending on the alcoholic beverage type and wine type. This also includes Municipal Tax and Health tax.

- Import fees and administrative charges.

- And Value-Added Tax (VAT) is 7%.

1.2. Reduction in taxes

But there is some good news. The recently-elected government cut excise duty on wine from 10% to 5%, as an effort to encourage tourism growth.

There are two excise tiers in Thailand. This rate applies only to bottles of wines that are priced above 1.000 bahts ($28.60), while wines below 1.000 bahts have zero tax.

1.3. Free Trade Agreements negotiations.

Australia, New Zealand, and Chile are exempted from taxes, as Thailand has signed Free Trade Agreements with these countries.

The future looks bright also for EU wine producers looking to sell their wine brands to Thailand, as free trade negotiations are taking place, and an FTA is expected to be signed this year.

2. Strict regulations

To protect consumer interests, the Thai Food and Drug Administration (FDA) has established a comprehensive set of regulations to ensure the quality, safety, and authenticity of wines imported into Thailand. This includes strict labeling requirements, certifications, and inspections to prevent counterfeit or substandard wines from entering the market.

3. Local prohibition timings

One thing that catches tourists off-guard when visiting Thailand is the ban on alcohol sales between 2 PM and 5 PM daily. Sales are also banned on Buddhist holidays, even in bars and pubs.

V. Wine importers in Thailand

If you’re considering entering the Thai wine market, finding reliable wine importers in Thailand is of key importance. We recommend partnering with seasoned importers who know the legal context and regulations and can help you navigate Thailand’s local market.

To help you kick off sales in the ASEAN region, BestWineImporters is offering a database with reliable, verified importers. We are also offering you a small FREE list with basic details about Thai wine importers. The platform includes a much wider range of data, including contact persons, details about the imported products and much more.

Napaphan 2010 Co.,Ltd.

Address: 252/209, 2nd Floor Muang Thai Phatra 2 Complex Huaywang, Dusit, Bangkok, Thailand

Phone: +66 2 693 3897

Website: napaphan.com

Vanichwathana Co., Ltd.

Address: 37-43 Anuwong Road, Chakkrawat, Khet Samphanthawong, Krung Thep Maha Nakhon, Thailand

Phone: +66 2 221 5354

Website: vanichwathana.com

Brand Connect Thailand

Address: Soi Surawong Bangrak District, Bangkok, 10500n, Thailand

Phone: +66 2 237 5224

Website: brandconnext.asia

Key takeaways

The Thailand wine market is expanding every year with more consumers being educated and willing to pay more money for premium quality wine.

There’s a massive demand for imported wine coming from restaurants and hotels accommodating the millions of tourists visiting the country each year. And, as we move forward, the Thai government seems to understand the multifold benefits of the wine trade and take some long-awaited measures to ease the import of wine into Thailand and also consumer’s purchasing capability.