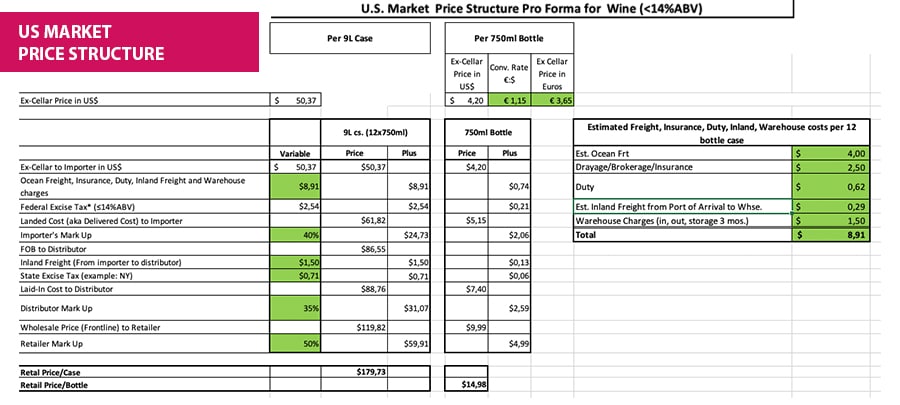

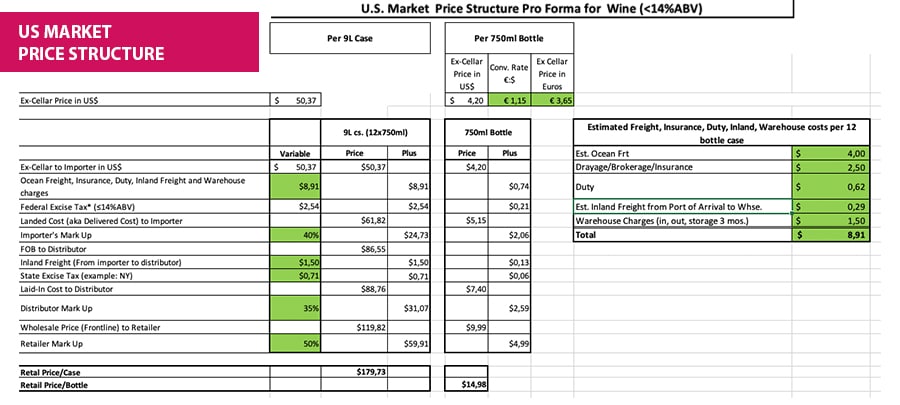

How do you price your wines in the U.S. in order to maximize your profit and successfully navigate the complex tax system which can prove a headache for a foreign wine producer who is looking to enter this complicated market?

Thanks to Steve Raye, our partner from Bevology, we’re offering you an easy to use tool in the form of an Excel price structure table that will allow you to get a clear idea about the U.S. wine pricing model.

Here is the link to the file

This applies to the U.S. Open states, as most of the Control states have their own price structures.

Understanding the pricing terminology

ABV: Alcohol by Volume

CBMTRA: Craft Beverage Modernization and Tax Reform Act details

DA: Depletion Allowance

Depletion: Product sold from the distributor to a retailer or on-premise client

FET: Federal Excise Tax

FOB: Freight on Board – the price of a product once it reaches an international transport ship.

Landed Cost: The amount paid by the importer (including excise tax) for receipt of goods at a warehouse

Laid In Cost: The amount charged to the distributor for receipt of goods from an importer (includes transfer costs, warehouse costs, state taxes)

Margin / Markup: The margin is the percentage difference between the selling price and the profit. The markup is the percentage difference between the actual cost and the selling price

MIP: Manager Incentive Program

MSRP: Manufacturer Suggested Retail Price

PA: Purchase Allowance

SPA: Special Purchase Allowance